Holistic Planning Process in Red Bank, NJ

Retire With Confidence

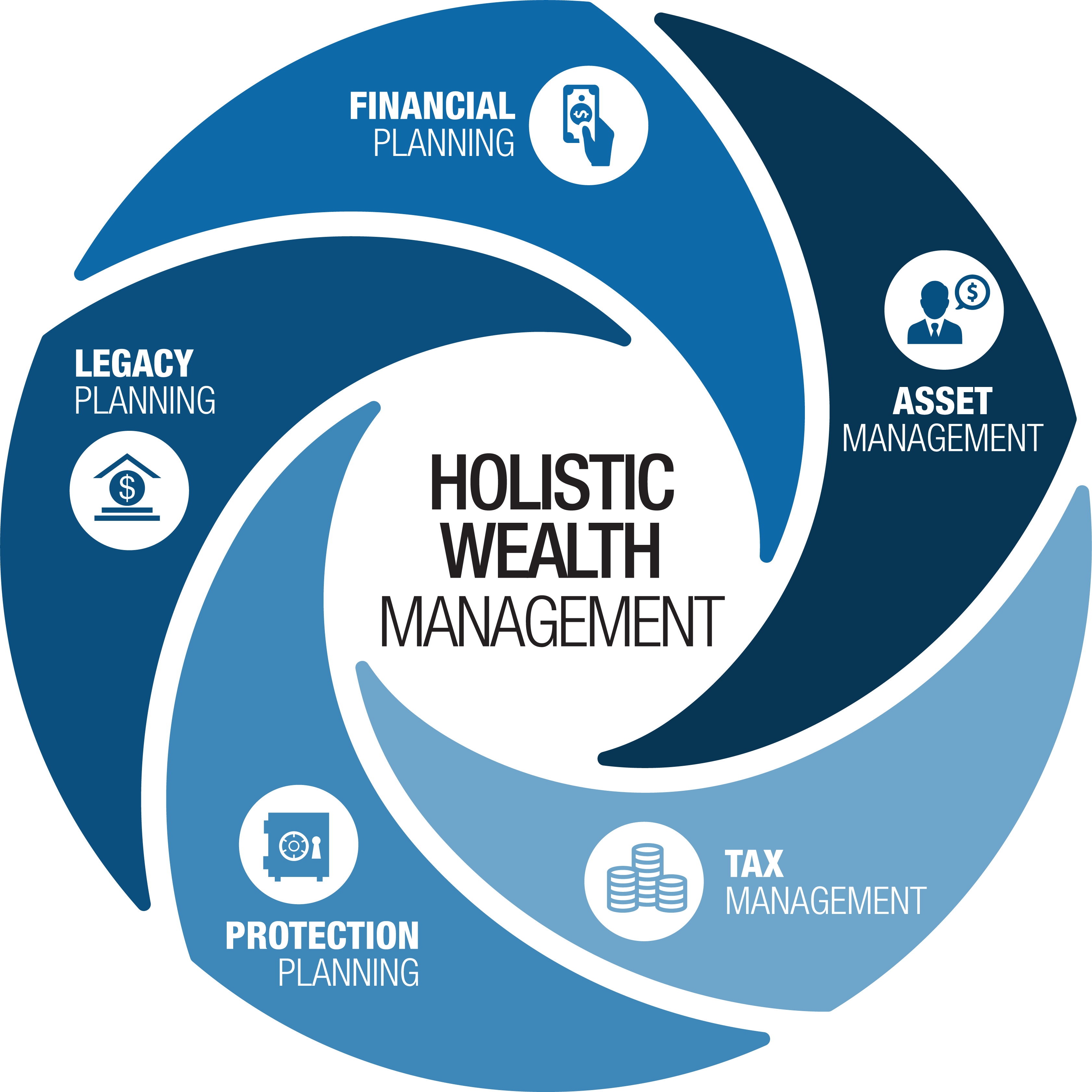

Our holistic planning process is designed to navigate the complexities of financial planning, avoiding critical gaps, tax inefficiencies, overexposure to risk, and unintended consequences. The Lynch Financial Group’s Bucket Plan Holistic Planning Process is a step-by-step approach that seamlessly integrates investments, insurance, tax, estate, Social Security, retirement income, and healthcare planning into one comprehensive strategy.

At The Lynch Financial Group in Red Bank, our mission is to synchronize all your hard-earned assets to collectively work towards achieving your goals, while minimizing inefficiencies such as investment overlaps, tax inefficiencies, and missed savings opportunities. We ensure your plan is devoid of missing or outdated legal documents, failure to identify and achieve pre- and post-retirement income goals, and misaligned strategies among professionals, making us a trusted partner in financial planning across NJ.

"We are very satisfied with the services of the Lynch Financial Group and would not feel as comfortable anywhere else."

-Mike and Maryellen G 1/2/23

The above testimonial are the views of this individual client and do not represent the views of all clients. No compensation was provided for this review. This testimonial does not provide guarantee of future performance or success.

The Bucket Plan Holistic Wealth Management Process

Expert Coordination

We ensure all aspects of your financial and retirement planning are harmonized, ensuring a coordinated effort across all services for our clients.

Diversifying Investment Goals

We time-segment investments to meet immediate, short-term, and long-term goals, tailoring our strategies to suit the unique needs of those in NJ and beyond.

Reliable Income Streams

Our goal is to create a dependable income stream throughout retirement for you and your family, ensuring financial security and peace of mind.

Easily Understood Planning

We provide a retirement plan that you can comprehend and appreciate, customized to reflect your unique situation and aspirations, making financial planning accessible to everyone

Your Trusted Monmouth County Retirement Planning Firm

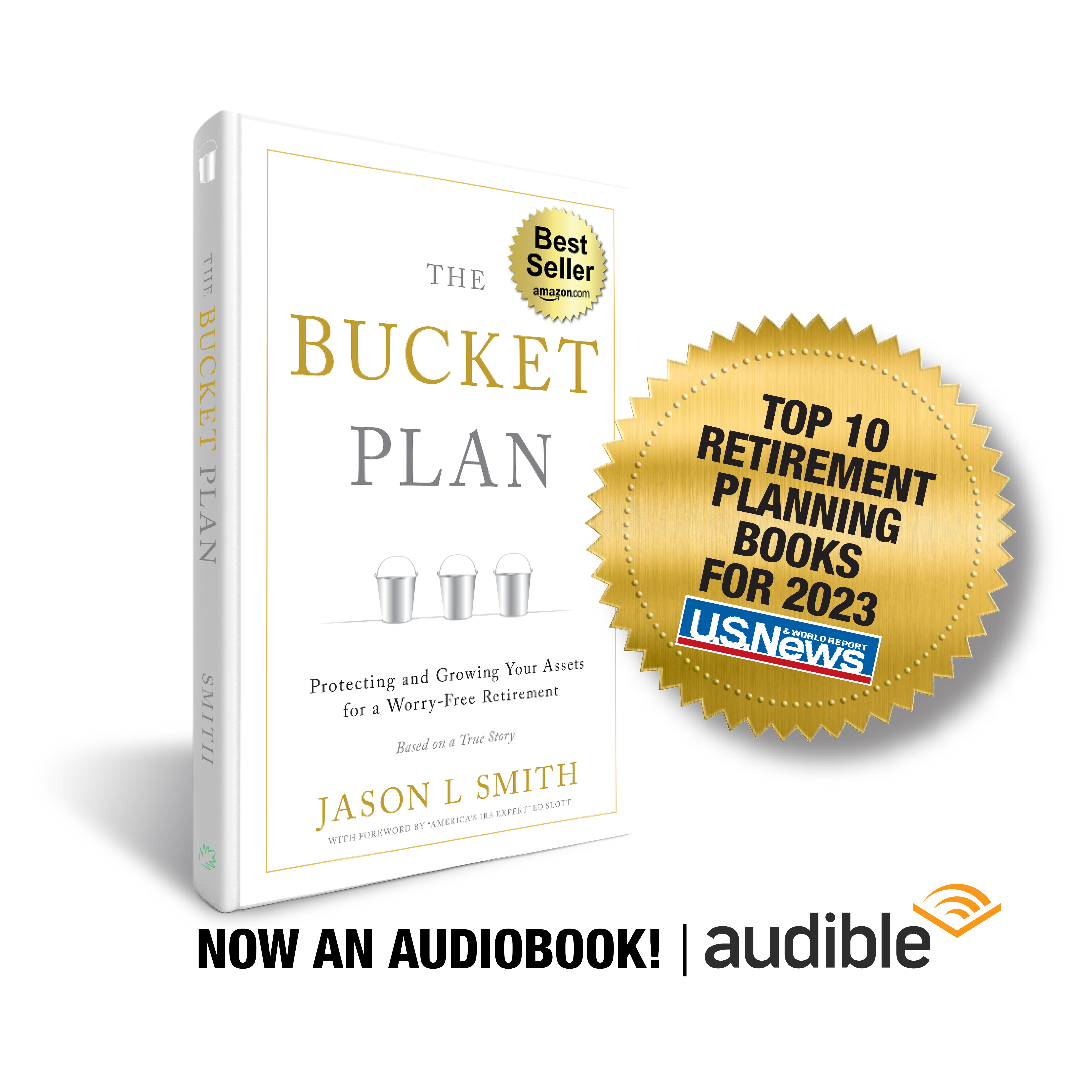

Understanding The Bucket Plan Philosophy

The Bucket Plan® Philosophy is a refined, strategic approach to asset allocation, designed to counteract the financial threats and challenges of today, especially pertinent for those at or nearing retirement. Facing market risk, interest rate risk, and sequence of returns risk requires a sophisticated planning philosophy to extend retirement savings effectively.

Developed specifically to cater to the varying investment time horizons, volatility tolerances, and income needs of our clients, The Bucket Plan® segments money into three distinct buckets. This philosophy is at the heart of our approach to wealth management for residents of NJ, and surrounding areas, aiming to ensure your retirement dollars meet your needs throughout the entirety of your retirement.

Financial Planning and Advisory Services are offered through Prosperity Capital Advisors (“PCA”) an SEC registered investment adviser with its corporate registered office in the State of Ohio. PCA and its representatives are in compliance with the current registration requirements imposed upon registered investment advisers by those states in which PCA maintains clients. PCA may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any subsequent, direct communication by PCA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. The Lynch Financial Group and PCA are separate, non- affiliated entities. PCA does not provide tax or legal advice. Insurance, Investment, and Tax Services offered through The Lynch Financial Group are not affiliated with PCA. Information received from this website should not be viewed as investment advice. Content may have been created by a Third Party and was not written or created by a PCA affiliated advisor and does not represent the views and opinions of PCA or its subsidiaries. This site may contain links to articles or other information that may be contained on a third-party website. PCA is not responsible for and does not control, adopt, or endorse any content contained on any third party website. For information pertaining to the registration status of PCA, please contact the firm or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about PCA, including fees and services, send for our disclosure statement as set forth on Form ADV from PCA using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

For important information related to PCA, refer to the PCA’s Client Relationship Summary (Form CRS), Form ADV Part 2A and Privacy Notice by navigating to www.prosperitycapitaladvisors.com.