The Lynch Financial Blog

Recent Articles

How To Retire Without a Pension: A Comprehensive Guide 2024

Did you know that a significant portion of the workforce is heading toward retirement without the safety net of a pension? In an era where

Unlocking the Secrets to Lower Lifetime Taxes: How Tax Planning, Management, and Preparation Can Save You Money

Introduction Imagine keeping a significant portion of your hard-earned money away from the government. Yes, it’s possible! Every dollar saved from taxes is a dollar

Guide to Paying Tax on Online Sales

Introduction Are you navigating the complex world of online sales and wondering about the tax implications? You’re not alone. With the surge of digital entrepreneurship,

5 Ways to Lower Your Taxes in 2024 & Beyond – Take Action Now!

Introduction As the US National Debt skyrockets to a staggering $34 trillion (US Debt Clock), it’s crucial to brace for potential tax law changes impacting

How to Save for Retirement without 401K: Step by Step

Do you lack access to an employer-sponsored 401k and wonder if your chances for a secure retirement are at risk? The 401k plan has long

What are Tax Free Retirement Options? A Comprehensive Guide 2024

How can one best prepare for a financially stable retirement? Thoroughly understanding the available retirement savings vehicles is essential. Among the most beneficial strategies for

15+ Best Retirement Gift Ideas: Ultimate Guide of 2024

Are you thinking about the perfect retirement gift ideas for someone special approaching their golden years? How do we celebrate such a critical moment, like

Beyond Savings: The Retirement Power of Cash Value Life Insurance

Maximizing Cash Value in Indexed Universal Life Insurance for Retirement Planning Planning for retirement requires careful consideration of various financial tools and strategies that can

Understanding Social Security Benefits – Maximizing Your Retirement Income

As retirement approaches, the decision of when to start claiming your Social Security benefits becomes paramount. The age at which you choose to elect benefits

The Impact of Inflation on Investment Accounts

As we age and prepare for retirement, financial stability becomes a top priority. One crucial aspect of retirement planning is understanding the impact of inflation

Customize Your Annuity: Building Retirement Security

📢🎉 It’s Annuity Awareness Month, and it’s time to stack up your financial future, just like you stack your favorite sandwich! 🥪 🔁 Imagine stepping

Did YOU Forget About Your 401(k)? – Potential Consequences of Leaving Account at Former Retirement Plan

📣Attention all job hoppers 📣 Did you forget about your 401(k) account from a previous employer. Or are you currently considering rolling over your 401(k)?

Debunked – Misconceptions About Annuities

🚫❌ Misconception 1: Annuities are too complex! ❌🚫 Truth: While annuities may seem intimidating, they are actually quite straightforward. In exchange for a payment of

What is an Annuity?

📣June is #AnnuityAwarenessMonth 🎉 Let’s begin by diving into what an annuity is… 🔍 What is an Annuity? An annuity is a contract between you and a

7 Advantages of an Annuity

Annuities can be a valuable tool in retirement planning. Let’s discover the advantages of owning an annuity and how it can benefit your financial future.

Advantages of THE Health Savings Account (HSA)

📣Check out the incredible advantages of having a Health Savings Account (HSA) and the tax benefits it offers! 💰💪 You must have a high deductible health

Market Monday – March 13th, 2023

Market Levels U.S. equities erased most of this year’s gains impacted by Federal Reserve Chairman, Jerome Powell’s comments at the semi-annual monetary policy report to

Market Monday – March 6th, 2023

Market Levels U.S. equities finished the week positive despite rising treasury yields. The Dow Jones broke a four-week losing streak ending the week 1.75% higher.

Tips WHY You Should Start Taxes Early

We get it, preparing your taxes is not the most exciting task. However, there are advantages to filing early which can create some beneficial planning

Market Monday – February 27th, 2023

Market Levels Stocks posted their worst weekly performance of the year last week as bonds yields and the US dollar rose in respect to the

Part 2: Tips For Tax Diversification

Tips for Tax Diversification Last week we touched on the Tax Diversification strategy and it’s importance to retirement planning. A quick recap of what the

Market Monday – February 20th, 2023

Investors get a break on Monday, February 20th as the markets are closed for the Presidents Day federal holiday. Year to date (YTD) (a) S&P 500

Tax Diversification

This strategy involves diversifying the different types of retirement accounts you may have investments in to help manage your tax liability. Some of the different

Market Monday – February 13th, 2023

Year to date (YTD) (a)S&P 500 +6.54% NASDAQ +11.96%Dow 30 +2.18% Sector Performance – 3 Month (b)Communication Services +17.73%Information Technology +15.91%Consumer Discretionary +12.33%Real Estate +11.90%Materials +8.05%Financials

Market Monday – February 6th, 2023

MARKET MONDAY – February 6th, 2023 (read below) Stocks closed in the red Friday but up for the week. The S&P was positive for two

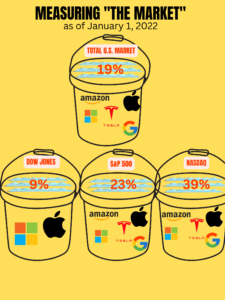

Measuring “The Market”

The illustration shown below takes a look at the weight of the top 5 stocks in each of the major indices in the US Market.

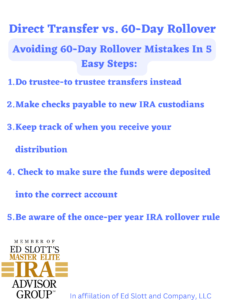

Direct Transfer vs. 60-Day Rollover (401k/IRA)

A 60-day rollover and a direct transfer are two different ways to move retirement funds from one account to another without triggering a taxable event.

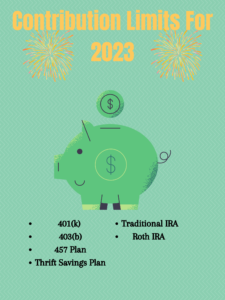

2023 Contribution Limits

New year = New contribution limits for 2023 for the following retirement savings accounts… 401(k), 403(b), most 457 plans, & Thrift Savings Plans – $22,500

Secure Act 2.0 – Required Minimum Distributions

Attention anyone with a 401(k), IRA, or qualified retirement savings account. The Secure Act 2.0 has been approved by Congress and is set to be

Tax Loss Harvesting Explained

Take advantage of LOWERING your taxable income for the year through tax loss harvesting… This technique can be used on taxable non-qualified brokerage accounts. There are two

The Power of Compound Interest

The Power of Compound Interest… Compound interest is basically interest that grows on interest of the accumulated principal in a savings account. The “power” of this concept

Year End Tax Planning Tips

As the end of 2022 is approaching, you should be aware of the different options available to you and how to ultimately decrease your 2022

Retirement Savings Accounts: Pre-Distribution Phase

What you should know Investing closer to retirement… Investing your money in preparation for retirement is much different than investing your money during your working years. Pre-retirees/retirees

The difference between TAX DEFERRED accounts and TAX FREE accounts

Would you rather pay on the seed or the harvest? The advantage of paying on the seed is you know what the price will be. The

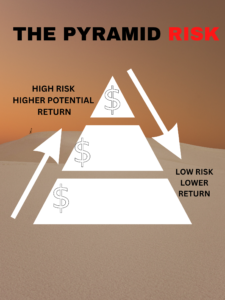

The “Pyramid of Risk”

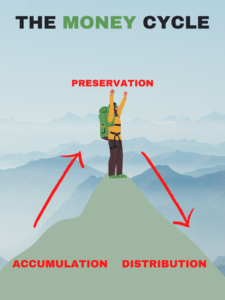

Designing an investment portfolio based upon age… When it comes to investing, age is a critical factor. The money cycle (as mentioned in previous posts)

Why you SHOULD invest in a Roth IRA TODAY

Attention ALL Roth IRA fans… Money grows tax deferred and comes out tax free while not subject to required minimum distributions 2023 may be your best chance to invest

How to take advantage of the IRS tax code

Did you know that your 401(k)-retirement savings plan is named after the IRS tax code “26 U.S. Code § 401”? This written tax code allows

The Money Cycle and the importance of the “Preservation Phase”

The PRESERVATION PHASE is the phase in your life where liquidity and safety of your money is most important. This phase usually begins when you

The Money Cycle

You are currently experiencing the money cycle and you may not even know it… The average person goes through three phases in their lifetime. It includes

Taxes: Pay Now vs. Pay Later

Which retirement lane would you like to travel? In retirement, the tax rate you pay is somewhat optional. You can either “Pay Now” or “Pay More Later”.

What is “Market Risk”?

What is Market Risk? Market risk is the impact of volatility on your retirement savings accounts, the risk vs. reward of those investments, and the cost of deprivation

Net Unrealized Appreciation

Do you get company stock through your employer plan? Are you planning on leaving/changing jobs? Do you want want to take advantage of a more

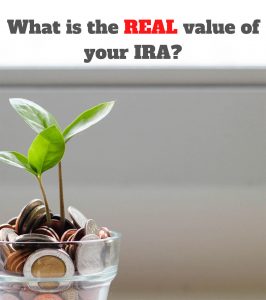

What is the REAL value of your IRA?

When you look at your IRA/401k statement, have you ever wondered how much of that money is really yours? Generally speaking, a distribution from an

What is an RMD (Required Minimum Distribution)

What is an RMD (Required Minimum Distribution)? An RMD is the minimum amount that must be withdrawn from a qualified retirement account each year. The